|

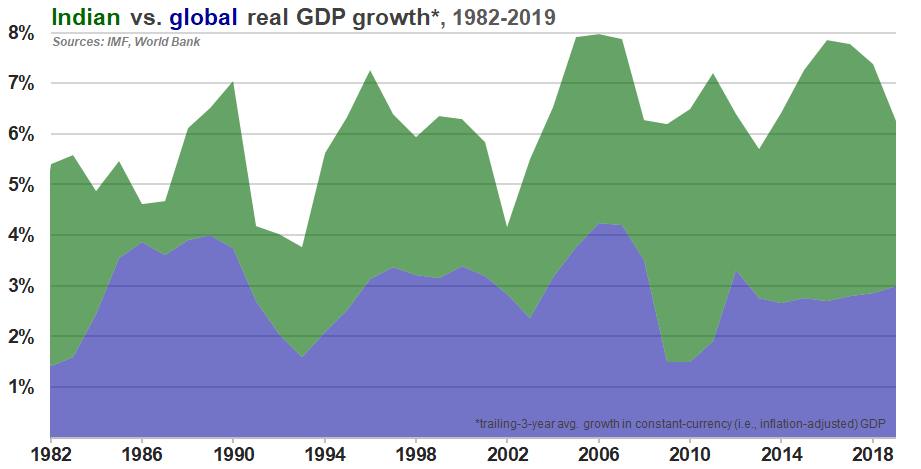

India has historically been able to maintain enviable rates of GDP growth even during global downturns, aided by factors including durable demographic tailwinds and the drops in oil import costs that often coincide with such slowdowns.

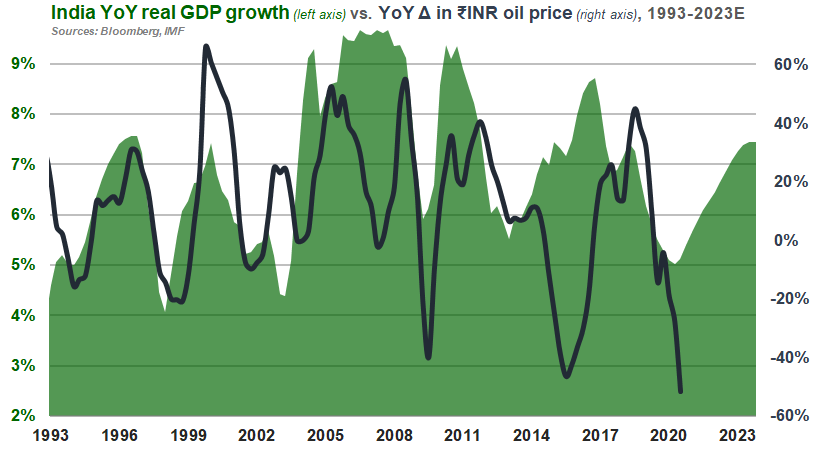

The world’s third-largest oil importer (behind China and the U.S.), India is an unambiguous beneficiary of lower oil prices. With limited domestic production, India relies on imports for more than 80% of its petroleum demand. The country’s 2019 crude oil import bill exceeded $120 billion – equivalent to over 4% of GDP and accounting for more than four-fifths of its overall merchandise trade deficit. Historically, significant declines in oil prices have for India been leading indicators of faster GDP growth, lower inflation, smaller current account deficits, and reduced fiscal deficits.

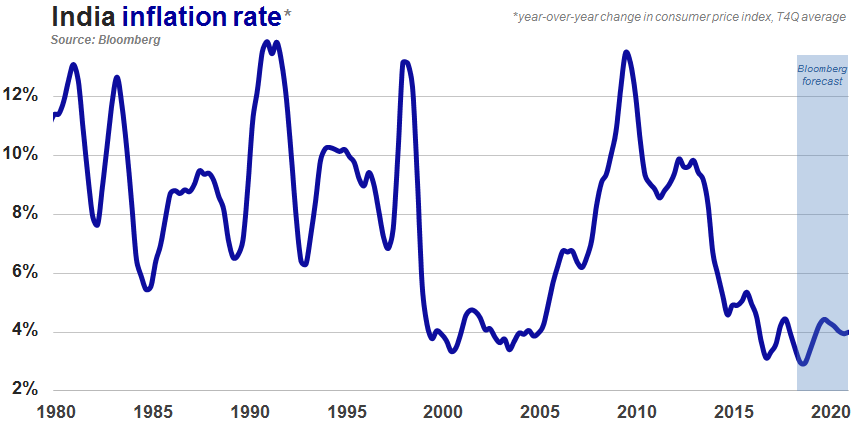

The pace of Indian consumer price inflation is hovering just above a two-decade low, driven by the combination of subdued commodity prices and relatively disciplined fiscal policy. Even as India's GDP continues to grow at the fastest pace of any major economy, muted inflationary pressures have cleared the way for two successive interest rate cuts by the central bank in recent months. More to come on this topic in an upcoming dispatch. Click here to return to the homepage.

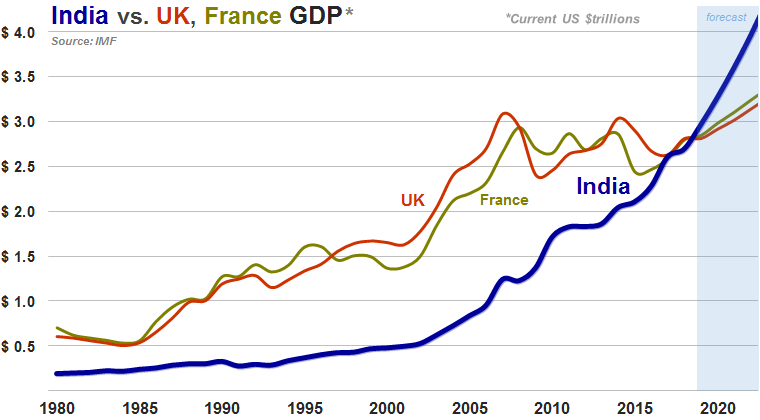

As recently as 2014, India's GDP (measured in current, a.k.a. "nominal", dollars at market exchange rates) ranked tenth globally. Having overtaken Russia, Italy, and Brazil over the past four years, India is on track to eclipse both the United Kingdom and France in 2019 to become the world's fifth-largest economy in current dollars. On a purchasing power parity basis (i.e., adjusted for differences in the cost of goods and services), India's economy is already larger than those of Germany, the UK, and France combined. More to come on this topic in an upcoming dispatch.

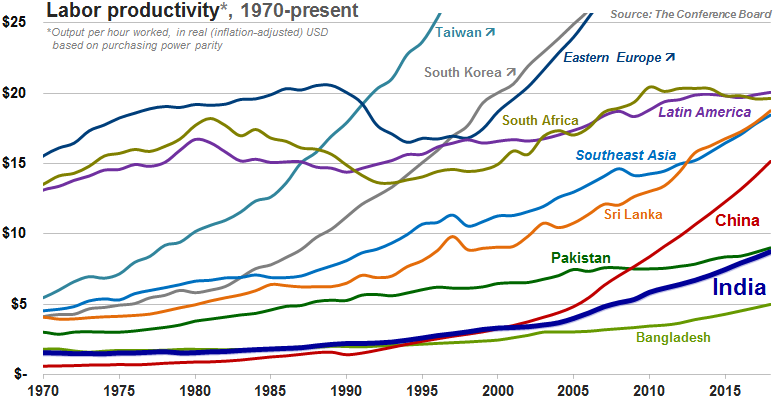

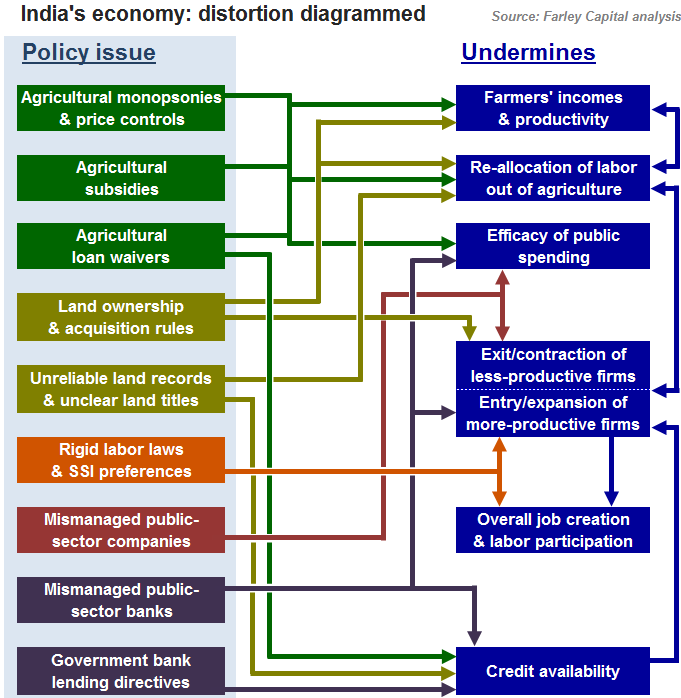

India’s productivity growth has significantly lagged that of China over the past couple decades, in large part due to a web of interrelated legal restrictions, market distortions, and counter-productive incentives that have warped the Indian economy’s allocation of resources and stifled the potential of the country’s workers and businesses.

For more on this topic, check out the India's unfinished revolution dispatch. Because India’s agricultural sector, land market, labor laws, and state-owned companies form a Gordian knot of interconnected dysfunction, solving any of these areas’ problems requires reforming all the others, as well.

For more on this topic, check out the India's unfinished revolution dispatch. |

|

|

© Farley Capital L.P. All Rights Reserved.

By using this website, you agree to our use of cookies, as explained in our privacy policy. |